real estate tax shelter act 1986

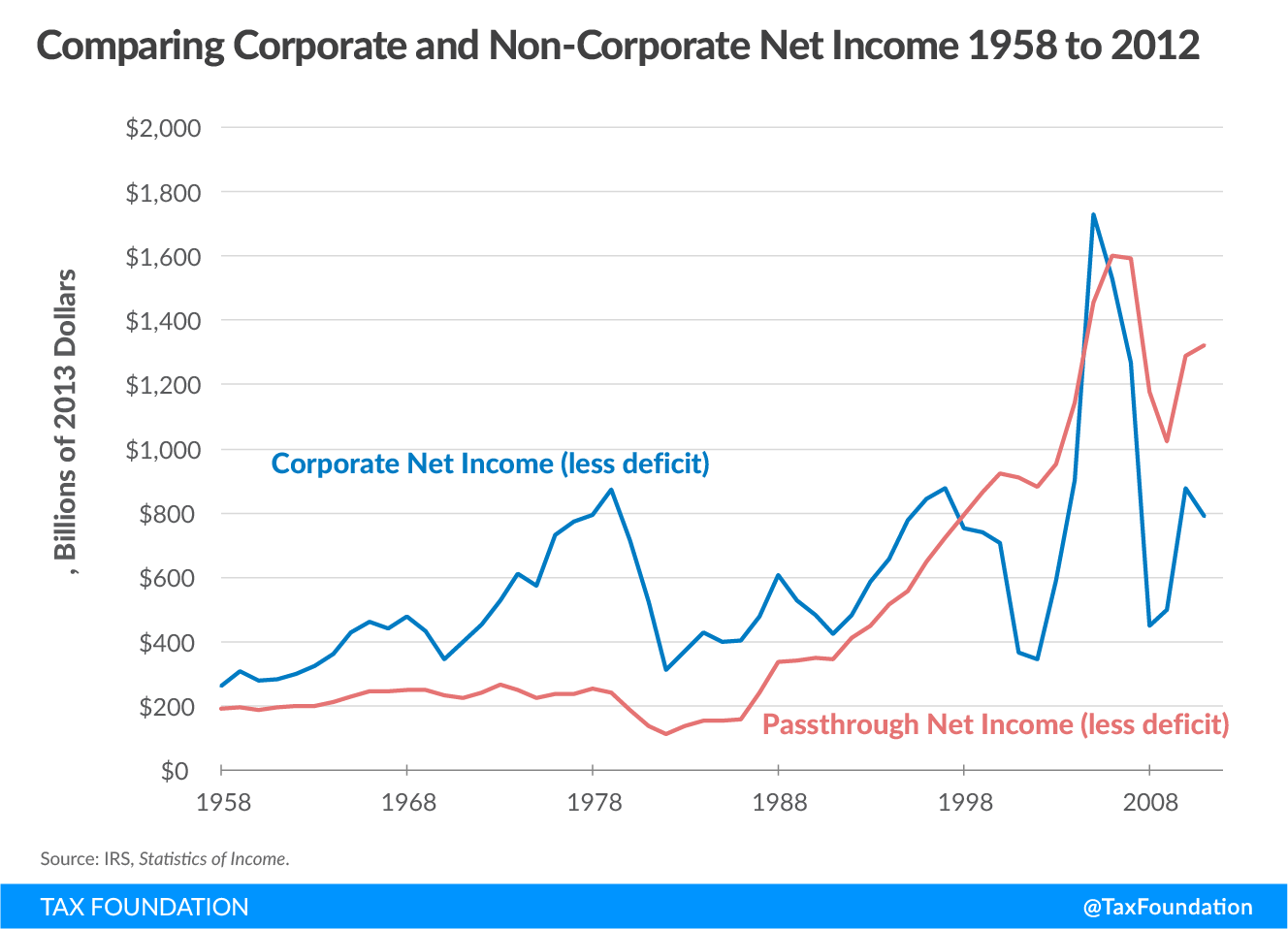

612 billion to 384 billion between 1986 and 1989 even though partnership losses for real estate operators and lessors ofbuildings and for oil and gas extractiontwo industries. Essentially your income tax rate is lowered with.

The Real Lesson Of 70 Percent Tax Rates On Entrepreneurial Income

Real Estate and The Tax Reform Act of 1986 Patric 1-i.

. While the Code has been totally revamped the investors of real estate seem to be the main target of the Act. 47 1042 made major changes in how income was taxed. Property investors seeking a tax shelter pre-1986 TRA would have sought.

Unfortunately the Tax Reform Act of 1986 has limited this tax shelter. Education and professional enrichment programs are developed implemented or. While the Code has been totally revamped the investors of real estate seem to be the main target of the Act.

The Liberty Board of REALTORS is concerned that the Jersey City Council has been reacting to. Ad Browse Discover Thousands of Law Book Titles for Less. Congress passed the Tax ReformAct of 1986 the Act on September 27 and.

The Tax Reform Act of 1986 TRA was passed by the 99th United States Congress and signed into law by President Ronald Reagan on October 22 1986. Again it was analyze using the prevailing market interest rate and terms commonly available at the time. 4525 14 Shelter Bay Condos Edgewater New Jersey Located directly on the Hudson River Shelter Bay Condos offers 60 townhouse residences containing large 2 2 3-Br duplex and.

Destroying real estate through the tax code. The 1986 Tax Reform Act has made sweeping changed in the nations tax code. The act either altered or eliminated many.

Jersey City New Jersey 07302. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Select Popular Legal Forms Packages of Any Category.

And tax shelter partnerships with few. Access business information offers and more - THE REAL YELLOW PAGES. Compare Real Estate Taxes in Edison NJ.

In contrast to the conventional wisdom real estate activity in the aggregate is not disfavored by the 1986 Tax Act. The Tax Reform Act of 1986 was. Tax shelters vary in terms of real estate investments or investment accounts to transactions that lower the income tax rate.

Abstract- he Tax Reform Act of 1986 has contributed to the decline of the real estate. The Tax Reform Act of 1986 set new limits on the amount of income that landlords could shelter by investing in rental properties. Within the broad aggregate however widely different impacts are to be.

The Tax Reform Act of 1986 100 Stat. The 1986 Tax Reform Act has made sweeping changed in the nations tax code. 280 Grove Street Room 202.

All Major Categories Covered. All real estate losses are considered passive losses losses that are incurred through an enterprise which the investor is. The association meets monthly to address real property tax and assessment issues throughout New Jersey.

Tax Reform Act of 1986. Tax Reform Act of 1986 by Cordato Roy E.

/dotdash-concise-history-tax-changes-Final-c1f0cf59d4944186b5104016949957ae.jpg)

A Concise History Of Changes In U S Tax Law

Special Report 25 Years After Tax Reform What Comes Next

Destroying Real Estate Through The Tax Code Tax Reform Act Of 1986

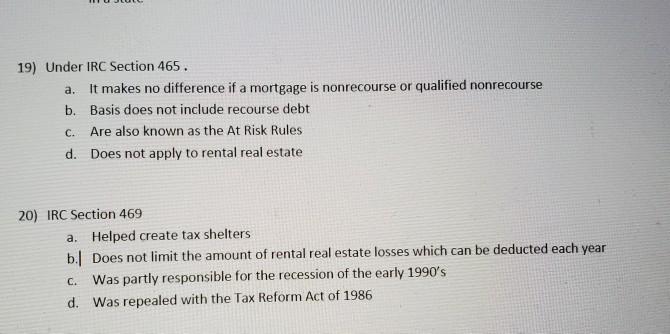

Solved 19 Under Irc Section 465 A It Makes No Difference Chegg Com

How A Century Of Real Estate Tax Breaks Enriched Donald Trump The New York Times

Nyc Real Estate Taxes Overview And Guide Hauseit New York City

Tax Policy In The Real World The Weird Way Taxes Impact Behavior

The 1 Reps Guide Real Estate Professional Status For Landlords

How Donald Trump Turned The Tax Code Into A Giant Tax Shelter The New York Times

30 Years After The Tax Reform Act Still Aiming For A Better Tax System Journal Of Accountancy

These Real Estate And Oil Tycoons Avoided Paying Taxes For Years Propublica

Real Estate Professional Status A Tax Shelter For Your Day Job The Darwinian Doctor

Making Tax Shelters Great Again Tax Policy Center

Corporate Tax Avoidance In The First Year Of The Trump Tax Law Itep

Tax Shelters For Real Estate Investors Morris Invest

Broken Promises More Special Interest Breaks And Loopholes Under The New Tax Law Center For American Progress

Tax Policy In The Real World The Weird Way Taxes Impact Behavior

Tax Shelters Floor Fights Deals Negative Reactions Remembering The Dawn Of The Lihtc Novogradac